We can support your nenkin refund(lump-sum Withdrawal payment).

🧾 Did You Know?

If you apply on your own, you may only receive 80% of your pension refund. We help you claim the remaining 20% tax refund too!

✅ Our Japanese experts handle the process quickly and accurately.

✅ We support to check your review status and help resolve any issues.

✅ All procedures are fully legal and compliant with Japanese regulations.

出国の1か月まえからじゅんびができます。最速でしんせいしましょう!

Our automated bot will respond to your inquiry via Facebook Messenger.

All nationalities are welcome

Lump-sum Withdrawal Payment can be claimed by anyone who meets the below conditions regardless of nationality and residency status.

Applicants vary, such as expatriates, university tutors, and technical intern trainees.

What are the requirements for applying?

- You are not a Japanese citizen

- You don’t have a Japanese home address

- You paid pension insurance for more than 6 months, less than 10 years.

- You are not entitled to receive any Japanese pension.

- You left Japan within two years (Your rights to get Lump-sum Withdrawal Payment is resolved by prescription in two years)

If you meet the above conditions, you are eligible for a lump-sum!

How Much You Get?

The case of interpreter Mai-san.

- working period 35 months (35 months coefficient is 2.7)

- average monthly salary 250,000JPY

2.7×250,000 yen= 675,000 yen

The case of expatriate Jack-san.

- working period 90 months (90 months coefficient is 5.5)

- average monthly salary 650,000 yen

5.5 x 650,000 yen = 3,575,000 yen

How to apply?& Claim Timeline

Fees

Form Request

If you would like to request our service, please fill out the form below.

We will send you contains details about the required documents and information.

Article

7 Points to Avoid When Applying for Lump-Sum Pension refund.

more

[2025]Japan’s Pension Refund How to claim and Common Issues: Expert explanation

more

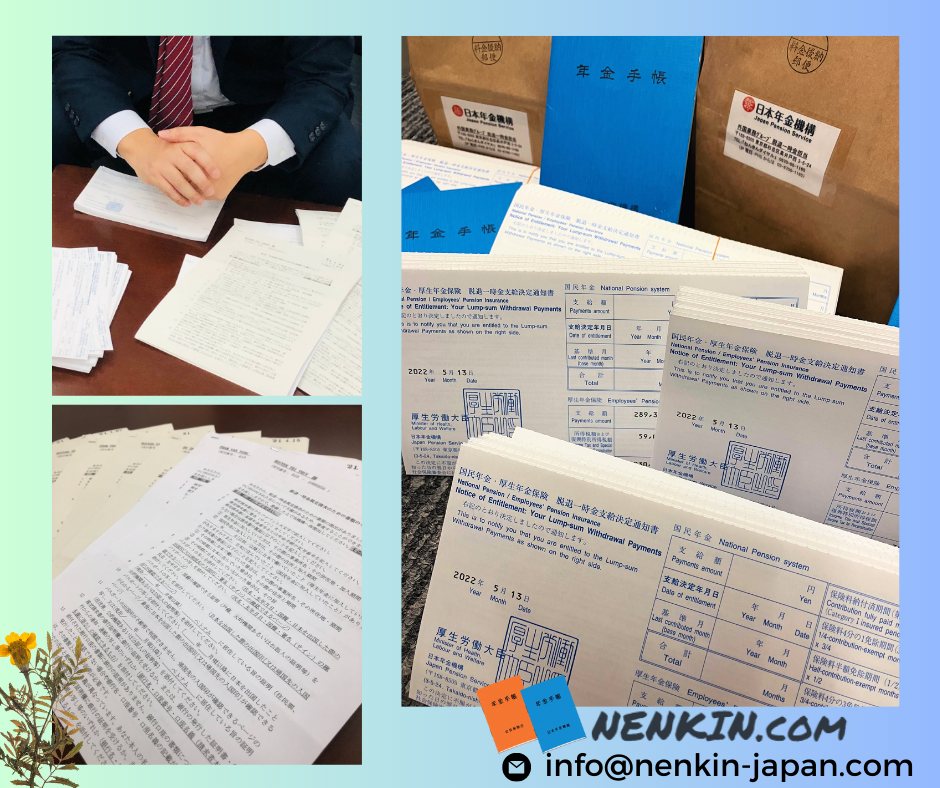

As your Japanese Branch

We are veterans of this area.

We offer a smooth and accurate nenkin application service for foreigners who work in Japan.

We, a licensed nenkin expert agency, apply for Lump-Sum Withdrawal Payment on your behalf. Only certified social insurance consultants can offer Lump-Sum application outsourcing services.

We have an excellent track record in this field. We’ve helped more than 35,000 foreigners and have received stellar reviews from them.

We can handle various cases regarding personnel labor matters since we have a reliable tax and legal experts network, including certified accountants, certified tax accountants, certified administrative procedures legal specialists.

We are here for you with the know-how we earned from years of experience.

About Us 平野国際労務事務所

| Office name | HIRANO Labor and Pension Consulting Office(平野国際労務事務所) |

| Office address | 〒460-0008 Aichi-ken,Nagoya-shi,naka-ku, sakae 1-22-16 Minami-sakae Bldg. 5F 愛知県名古屋市中区栄1-22-16 ミナミサカエビル5F |

| TEL & MAIL | |

| Established | June 13th, 2015 |

| Directors | Director: JUNJI HIRANO (Labor and Social Security Attorney、社会保険労務士) License No.23120151 愛知県社会保険労務士会所属 |

| Alliance | 小倉裕樹会計事務所 行政書士AOI国際法務事務所 |

| Services | ●Inbound These are services for foreign workers and the companies that employ foreign workers -A proxy service for Lump-Sum Withdrawal Payment -A proxy service for Lump-Sum childbirth allowance in case your child was delivered overseas. -Personnel management of foreign workers ●Correspondent Banks Mitsubishi UFJ Bank, Shinsei Bank, Rakuten Bank, and more. |

Please feel free to contact us.

お気軽にお問い合わせください

- 所在地 愛知県名古屋市中区栄1-22-16

ミナミサカエビル5F 平野国際労務事務所 - 電車でお越しの場合

名古屋市営地下鉄 東山線鶴舞線 伏見駅 6番出口 南へ徒歩5分 - 営業時間

平日9:00~18:00 / 土日祝定休