Only success-fee, No upfront fee!

If you can not receive your pension for some reason, there is no charge.

1. Pension application & 20% tax refund. Everything follow up.

| Total Amount of Lump-Sum Withdrawal Payment | Success Fee (Including Tax) |

| ~ Less than 1,800,000 yen | 30,000 yen |

| 1,800,000 yen ~ 2,800,000 yen | 40,000 yen |

| More than2,800,000 yen ~ | 50,000yen |

2. 20% tax refund support only

| Total Amount of Lump-Sum Withdrawal Payment | Success Fee (Including Tax) |

| ~ Less than 1,800,000 yen | 25,000 yen |

| 1,800,000 yen ~ 2,800,000 yen | 35,000 yen |

| More than2,800,000 yen ~ | 45,000 yen |

3. Other support

| menu | Handling fee |

| Reissuance of Lump-Sum Withdrawal Payment Notification | 5,000 yen |

| Submission of Moving-Out Notification and Other Related Documents | 5,000 yen |

| Change Procedures or Resending Requests After Application (Due to Customer’s Circumstances) | 20,000 yen~ |

| Application for other pensions, such as old-age pension. | ask |

If you would like to request our service, please fill out the form below.

The process can be completed entirely online(smartphone), and all you need to do is submit the necessary documents.

*You cannot apply for this procedure while having an address in Japan. If you have not yet left Japan, we will begin the process after you leave.

How to pay?

You do not need to pay in advance.

The 20% tax deducted from your pension will be transferred to our account by the tax office.

After deducting our fees, We will transfer the remaining to your account via International Remittance Service.

*If the tax refund and fee cannot be offset (e.g., if the amount is insufficient, or if the lump sum is only for a national pension), we will bill you separately for the missing fee.

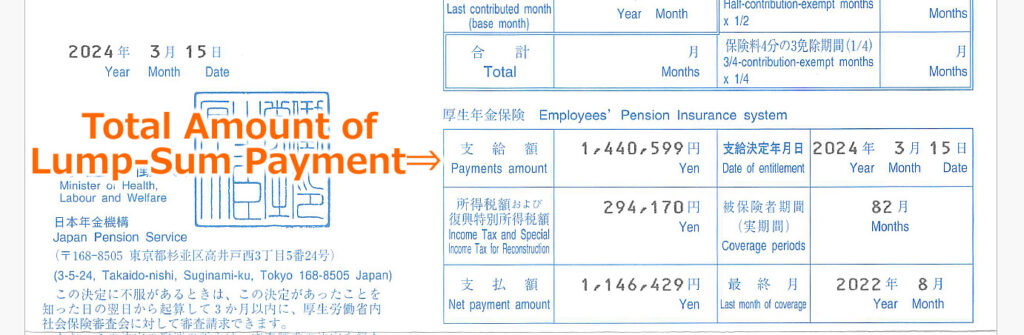

Where can I find the total amount of the lump sum?

Your final lump-sum amount will be stated in the approval notice (sample as below).

Once your pension is approved, the representative (us) will receive this notice, and we will share it with you immediately.

We cannot know the exact amount until this letter arrives.

However, the pension amount can be estimated based on your average salary and period of employment.

Let’s simulate an estimated total amount.

* It's just a trial calculation.The final amount will be determined by JPS and the tax office based on your payment record.