Contents

- Q.1 Is the email address for the Japan Pension Service disclosed?

- Q.2 I applied for my lump sum payment by myself but haven’t received any response from JPS yet. How long do I have to wait? And what happens if I submit an incomplete application?

- Q.3 What is an “bank account certificate” in the required documents?

- Q.4 Can I have my lump-sum refund paid into a Japanese bank account?

- Q.5 We requested an agency to apply, but have not heard from them at all for more than 6 months. Can I request another agency?

- Q.6 I did not delete my Japanese address and left the country. Can I get a pension?

- Q.7 I plan to re-enter Japan. Please let us know what to keep in mind.

- Q.8 I have worked in Japan for over 10 years. Can I also receive the Lump-sum Withdrawal Payment?

- UsefulVocabulary

Q.1 Is the email address for the Japan Pension Service disclosed?

A.

The email address for the Japan Pension Service is not disclosed.

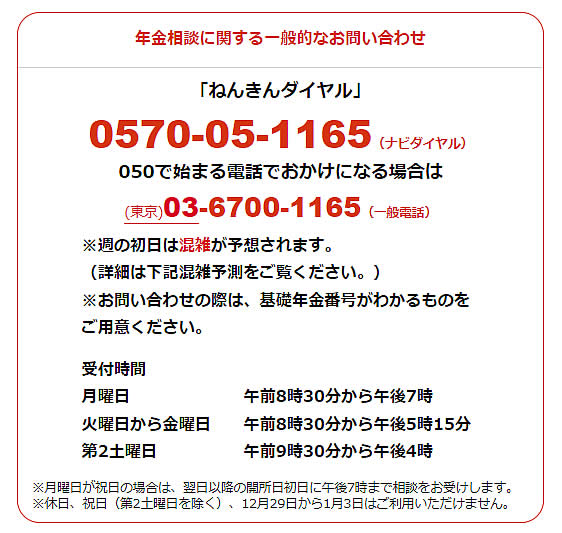

There are two ways to contact the Pension Service: by phone or postal mail.

However, in the case of phone calls, the response is generally in Japanese and limited to general explanations.

(There may be interpreters available.)They will not provide you with information about your individual examination status or pension enrollment over the phone.

Unfortunately, this is very unfriendly and inconvenient for foreigners.

⇒⇒The phone number for JPS from oversea.

+81-3-6700-1165

We offer paid application support as your representative.

We can handle applications for lump-sum withdrawal payments and old-age pensions on your behalf.

As your Japanese agent, we can mediate with the Pension Service.

If you are interested, please contact us.

Q.2 I applied for my lump sum payment by myself but haven’t received any response from JPS yet. How long do I have to wait? And what happens if I submit an incomplete application?

A.

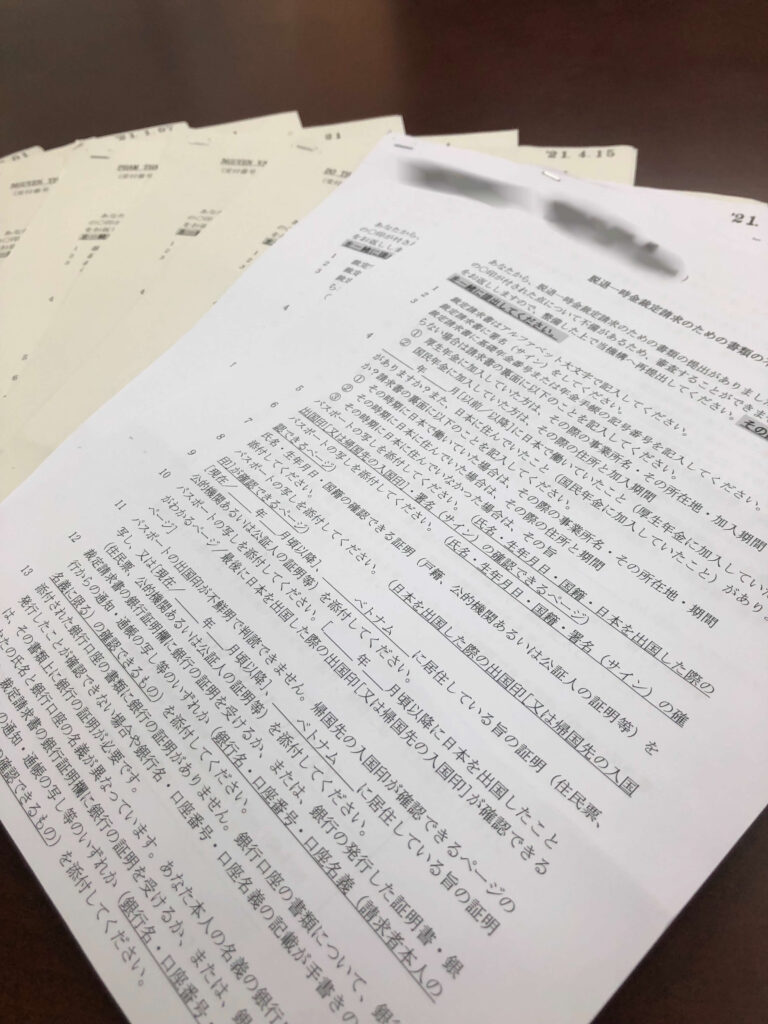

Normally, it takes about 5-6 months for a decision to be made, so please wait patiently for at least 6 months. If there are any errors or deficiencies in your application, the JPS will usually send a letter explaining the reason for the error to your overseas address or your agent’s address. It is important to address any deficiencies and resubmit the application as soon as possible, as an incomplete application will cause the reviewing process to stop and you will be pushed to the back of the line.

However, for some reason, this letter is often not received.

We can resolve this issue by checking the situation directly with the JPS.

In this case, please contact us using the application form below, attaching the necessary documents.(In this case, We will handle this for an upfront fee. It need a power of attorney to us.)

Documents returned by JPS due to incompleteness ⇒ ⇒ ⇒

Q.3 What is an “bank account certificate” in the required documents?

A.

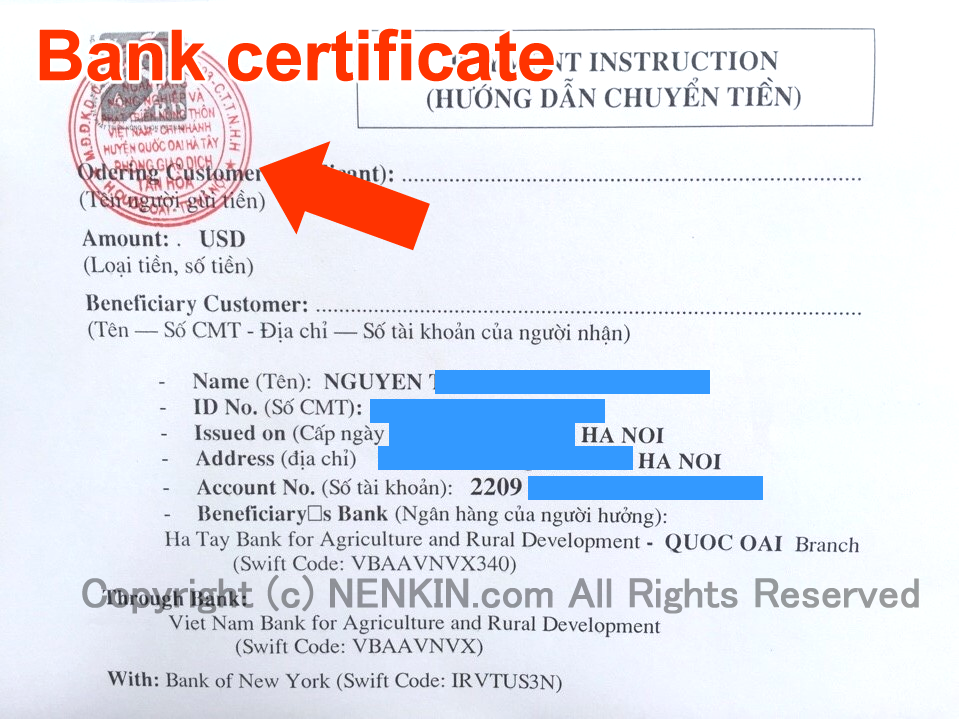

The account certificate is a document issued by the bank that says the account is real.

It contains the name of the bank, the bank seal or signature, the name of the branch, the name of the account, and the account number.

For Japanese banks, it is usually the cover page of the account passbook.

Documents containing the following information are best.

the name of the bank,

the name of the branch,

the account number,

the name of the account.(The account must be in your name)

Other acceptable documents include a screenshot of the bank’s website after you have logged in.

If possible, documents are better.

If you are not sure, please send it to us once. We will check and feed back to you.

Q.4 Can I have my lump-sum refund paid into a Japanese bank account?

A.

Yes, sure.

Many people put bank account details in their country, but you can also have it paid in Japanese banks.

However, JPS can’t transfer your refund to YUCHO-bank and certain banks overseas.

If you get it settled into a bank overseas, it will generally be paid in dollars.

If you specify a Japanese bank, the money will be sent in Japanese yen.

Q.5 We requested an agency to apply, but have not heard from them at all for more than 6 months. Can I request another agency?

A.

Not getting a pension is a common problem with unqualified agents.

However, double applications confuse the JPS.

It need to be very careful. You had better do not double apply.

If do that, Which agent is the official agent, and the JPS will send you a confirmation document.

This takes even more time.

If it has been more than six months since your application and you have not been notified, please contact us.

We will check the situation directly with the JPS.( It need a power of attorney to us.)

Q.6 I did not delete my Japanese address and left the country. Can I get a pension?

A.

In that case, You may not meet the requirements.

This is the The following two conditions must be met.

・You have left Japan after submitting a notification of moving out of the country to the municipality

・You have resigned from your company in Japan.

On the other hand, Your residence card has an expiration date, and when it expires,

your Japanese address will be automatically deleted.

However, this procedure takes much time, so you should still voluntarily delete your address.

There are a great many cases where the examination is delayed because the address has not been deleted.

If you leave Japan without deleting your address, we can delete it for you.

Q.7 I plan to re-enter Japan. Please let us know what to keep in mind.

A.

The maximum pension calculation period is 5 years.

If you work in Japan for more than 5 years, the calculation of the Lump-sum Withdrawal Payment will be 5 years.

If possible, it is best to apply every 5 years, But it depends on your life plan and employment contract.

This is why some people leave the country to apply and then re-enter.

When applying, it is important to delete your address and resign from the company.

This is determined by the circumstances on the date the application arrives at the JPS.

JPS will affix a dated receipt stamp to the application upon arrival.

You must meet all of the qualifications on this date.

Re-entry must be handled with care.

Any mistakes will result in you not receiving your pension.

Q.8 I have worked in Japan for over 10 years. Can I also receive the Lump-sum Withdrawal Payment?

A.

If you have lived in Japan for more than 10 years, you can not receive the Lump-sum Withdrawal Payment,

but you will receive the Japanese old-age pension after you turn 65 years old.

This is not an option, automatically changed.

Note that the 10 years is not the “period you worked” or the “period you paid pension”.

It is the period during which you had a domicile in Japan.

Therefore, even if you were exempted from the pension for 3 years and worked for a company for 7 years, you are still eligible for the old-age pension. (It can not receive the Lump-sum)

You can apply for old-age pension from abroad.

But if you are abroad, you will not be notified from JPS.

You will need your pension number to apply. Remember to apply for it when you turn 65.

UsefulVocabulary

Important terms and phrases related to the pension refund process.

Here are some useful vocabulary terms and phrases related to the Japan pension refund process:

– Pension Insurance Number: Your unique identification number for the Japanese pension system.10 digits.

– Residence Card(Zairyu- card): A document that proves your legal residency in Japan.

– Passport: A document that verifies your identity and confirms your departure from Japan.

– Bank Account Information: Your bank name, branch name, account number, and SWIFT code.

– Proof of Departure: A document that confirms your permanent departure from Japan.

– Proof of Address: A document that verifies your current address outside of Japan.

– Application Form: The primary document for your pension refund request.

– Tax Return: A document that you file with the Japanese tax authorities to claim a tax refund.

– Power of Attorney: A document that authorizes a pension and tax representative to act on your behalf.

– Tax Representative: A licensed tax accountant or a qualified tax professional who can file your tax return on your behalf.

– Refund Amount: The amount of money you will receive back from the Japanese pension system.

– Tax Refund: The amount of income tax you will receive back from the Japanese tax authorities.

-Fiscal Year: The Japanese fiscal year runs from Jan 1st to Dec 31st.

-Deadline: The last date to submit your pension application or tax return.